What is off-exchange trading ?

Further, EU regulation has reinforced this trend with the abolishment of the concentration rule back in 2007, which led to a significant reduction in market entrance barriers for new coming platform operators (MiFiD I).

There are now more trading channels than ever

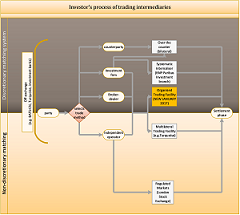

In the diagram on the left, I display all of the possible trading channels that can be considered as on & off-exchange under the legal terminology employed in the EU (MiFiD II). Given that one of the strongest factors of differentiation among the actors is transparency, I’ve taken the liberty of splitting the diagram using a color legend by levels of discretion with respect to order book flow execution transparency and information display. We have two categories: the dark one containing “discretionary matching systems” and the, in lighter shade, the “non-discretionary” ones (MIFID II: The new market structure paradigm, Linklaters, 2014).

In the diagram on the left, I display all of the possible trading channels that can be considered as on & off-exchange under the legal terminology employed in the EU (MiFiD II). Given that one of the strongest factors of differentiation among the actors is transparency, I’ve taken the liberty of splitting the diagram using a color legend by levels of discretion with respect to order book flow execution transparency and information display. We have two categories: the dark one containing “discretionary matching systems” and the, in lighter shade, the “non-discretionary” ones (MIFID II: The new market structure paradigm, Linklaters, 2014).

Discretionary vs non-discretionary: the sole common variable to distinguish them all

Discretionary matching systems encompass all types of trading methods, such as Internalisers, Organized Trading Facilities (EU) and Swap Execution Facilities (USA) not having or making accessible the order book flow to third-parties, nor the order itself at the moment of trade. The intermediaries (third-party facilitators) can intervene in the order execution & management process, meaning there is less pre- and post-trade transparency relative to regulated markets. Anonymity is not the sole advantage of such orders. Additionally, these benefit from increased flexibility in the way that they can be canceled out even after a match has been found. This is especially useful when passing combined and large orders.Non-discretionary matching systems comprise all the rest, more specifically, Multilateral trading facilities/Alternative Trading Systems (ATSs) and traditional stock exchanges such as Euronext Brussels. In this segment, third-party operators have no say to how are the orders executed and do not have the legal authority to, for example, discriminate among orders received and decide whether to or not to report trades to participants. Non-discretionary matching declinations run centralized orders books that make trade information available in real-time to platform participants. Nevertheless, it is important to note that legally, nothing prevents MTFs or regulated market operators from operating more than a single platform, such as a combination of an non-discretionary and a discretionary platform. Actually, operating different trading platforms and methods is a common practice within the business of market operators. I confirmed this business trend through an interview with one of the directors of Euronext Brussels, Johan Verschelden . In fact, according to him, off-exchange trading services are complementary to those offered by RMs . We will later try to assess whether this practice can be assessed through data or literature and his inference confirmed.

Where does the demand for a different kind of venues stem from ?

Back in 2014, Dr. Barnes, CEO of Turquoise (the dark pool platform of the LSE) gave a very academic speech explaining why and for whom do dark pools exist. The topic of dark pools is deeply integrated into today's capital market structure and is known by any heavy weight fund manager. Therefore, I warmly recommend the video below as introductory material to the topic.